Peligri and Company, Certified Public Accountants Hackensack, NJ

Every time your song is played, you receive a royalty payment, which compensates you for the use of your intellectual property. Similarly, if you are a business owner who licenses a patented technology, you may receive royalties based on the sales or usage of that technology. Royalties come in different forms, ranging from copyright and patent royalties to franchise fees and mineral rights. The calculation, recognition, and allocation of royalties require careful consideration of factors such as the basis for royalty calculation, tracking of sales or usage data, and compliance with contractual obligations. Adhering to accounting standards, such as ASC 606 or IFRS 15, is crucial for consistent and transparent reporting.

Base pay range

- They are based on an agreed-upon percentage of revenue, profits, or a flat fee and serve as compensation for the use of intellectual property or other valuable assets.

- For example, when a company licenses a software program for its employees’ use, the software developer receives royalties based on the number of licenses sold.

- YPC has been extremely successful, well received and has grown significantly.

- Determining the appropriate breakpoints, thresholds, and rates can be challenging, and ongoing reassessment is often necessary.

- It’s worth noting that royalties can take different forms depending on the nature of the agreement.

- Royalties can apply to physical products, technology, intellectual property, and resources.

For example, when a company licenses a software program for its employees’ use, the software developer receives royalties based on the number of licenses sold. This also applies to mobile applications, where developers earn royalties based on the number of downloads or in-app purchases. In the music industry, artists and songwriters receive royalties for the use of their music.

Income Statement

In correspondence with the SEC, the company explained how it determines that these sales fall under the sales- and usage-based royalty exception. Example 1 – Sales-based royalties accounting Royalty Harper, a singer has licensed his music to an online music retailer, Pentatonic. Pentatonic pays Harper $0.25 for every song of his sold through their website.

Resource rights

This is a simple example, but it does help to demonstrate the impact of royalties on a business. Imagine that your newly released, internationally acclaimed title A Guide to https://www.bookstime.com/ Simple Royalty Management has just earned its first sales. Your distributor has informed you that it has sold 10,000 copies in its first day, generating £100,000 of revenue.

Royalty Rates

- Estimating the fair value of royalties can be a challenge, especially when the royalties depend on uncertain future outcomes.

- Royalty agreements can be complex, involving multiple parties, different types of intellectual property, and varying terms and conditions.

- In this process, no consideration is given on whether the transfer of the proprietary element has been concluded or not.

- The question of how this expense is entered on your business tax return depends on the specifics of your situation.

- Innovators, inventors, creators, intellectual property owners, and landowners can benefit from a royalty income.

Additionally, an initial franchise fee of $45,000 is paid to the McDonalds corporation. Royalties can be paid out to an author for books sales, a songwriter for a song, or to a musician for an album. The question of how this expense is entered on your business tax return depends on the specifics of your situation. Before you attempt to include any of these royalties or licensing fees as expenses, check with your tax professional. Like other forms of payment in a business, royalties are taxable income and also a business expense.

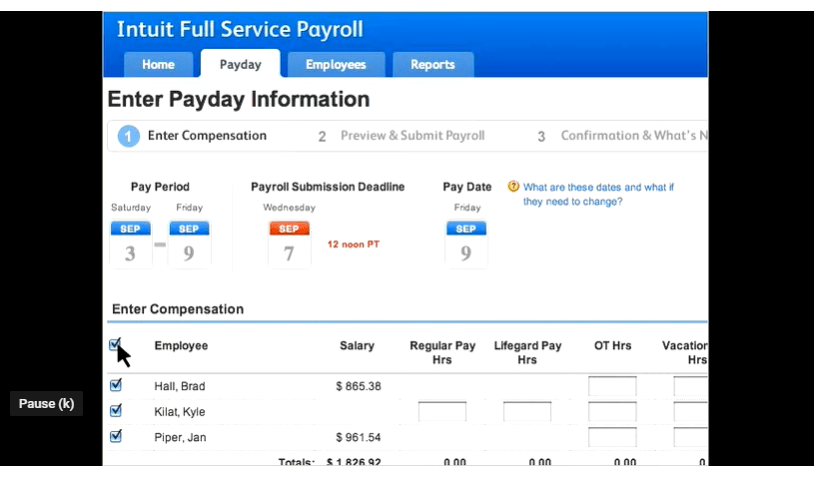

Setting Up Payments

Properly recognizing royalties in financial statements is crucial for providing accurate and transparent financial information. It ensures that stakeholders have a clear understanding of the revenue generated from licensing arrangements and allows for effective comparability across periods and companies. Companies should carefully follow accounting standards and guidance to ensure consistent and appropriate recognition of royalties in their financial reporting. This ensures that payments are rendered in a timely manner and in the correct amount. Accounting processes vary based upon the nature of payments made and other contract stipulations, so it’s important to know the specific entries required for each type of transaction. In summary, royalties in accounting are payments made by a licensee to a licensor for the use or exploitation of an asset.

Regular Royalty Payments

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Peligri & Company is a full-service accounting firm located in Hackensack, New Jersey. We will provide you with high-quality, professional servicewith a personal touch. The Young People’s Chorus of New York City (YPC) is a multicultural youth chorus internationally renowned for its superb virtuosity, brilliant showmanship, and innovative model of diversity. YPC is committed to empowering our youth and providing pathways to success through the arts so that each child, regardless of race, gender, socioeconomic background, or religion, can reach their full potential.

Generally, consideration in a sales-based royalty agreement is contingent upon and paid out as the licensee sells goods or services that utilize the licensed IP. In many cases, a sales-based royalty is paid out as a portion or percentage of sales revenue generated using the licensed IP. Businesses must navigate these challenges to ensure accurate financial reporting and maintain transparency in their royalty-related activities. A royalty agreement is a legal contract between a licensor and a licensee.

Royalty Accounting in Different Industries

By offering a monetary reward tied to the success of their creations, royalties motivate individuals and businesses to invest their time, talent, and resources in developing new and valuable assets. Whatever the case, the terms of royalty payments will be outlined in the licensing agreement. They can include things like royalty cuts, the portion of royalties, and the overall royalty structure.

- For intangible assets such as music, rates might be negotiated by industry groups on behalf of artists.

- Professionals in this field must stay abreast of current practices and standards to maintain accuracy and integrity in their work.

- In a way, royalties can protect the owner of the property as they ensure the property is being used properly.

- Copyright law gives the owner the right to prevent others from copying, creating derivative works, or using their works.

- It is unrelated to costs of technology development or the costs of competing technologies.

- Artists, songwriters, and producers earn royalties from physical sales, downloads, streaming, and performance rights.